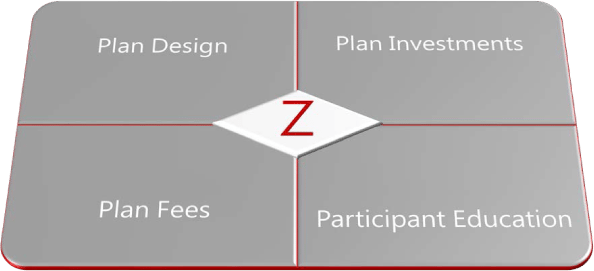

Z Plan Optimization

Our approach to plan management includes a comprehensive review of your retirement plan, focusing on the four cornerstones of a retirement plan, including plan design, plan investments, plan fees and participant education.

Plan Design:

With extensive knowledge in plan design and plan administration, we work with plan sponsors to create an opportunity to enhance participant outcomes by changes in plan design. We begin by understanding the goals of the organization, reviewing plan participation, employee deferral rates, and employer contributions, then introduce ways to produce more efficient outcomes that are aligned with company values.

Plan Investments:

Whether you are looking for a more active role in investment selection or a do-it-for-me approach, we work with plan sponsors to develop an investment strategy for the plan. Our research helps guide plan sponsors to create a retirement plan investment menu designed to give participants the flexibility to choose among different asset classes and investment strategies. Our approach includes more than 15 qualitative and quantitative metrics used to select and rank investment options, managers and investment strategies across multiple asset classes, style and peer group rankings and rick-adjusted return characteristics.

Plan Fees:

The Department of Labor requires plan sponsors to take an active role in determining whether retirement plan expenses, features and services of a plan are reasonable and competitive in the marketplace.

As a full disclosure organization, we embrace this regulation, and work closely with our clients to shoulder much of this responsibility by providing a thorough market analysis. We identify retirement plan providers who deliver the highest quality products and services at the most competitive total cost while keeping your unique circumstances in mind. Within the framework of our analysis, we will present a balanced analysis of the different plan provider components including: recordkeeping, technology, compliance, investment management, communications and costs. This process allows us to identify core strengths and weaknesses of each prospective bidder.

Participant Education:

Defined contribution plans play an increasingly important role in the future of retirement. For many participants, these plans will be their primary source of retirement income. Plan sponsors shoulder a huge responsibility to keep employees informed.

We believe the key to long-term financial planning is education and committing to a process of investing. We work with plan sponsors to institute a customized education and enrollment strategy to fit their organization and employee demographics. Our consultants will provide periodic on-site group enrollment and education meetings for employees at all levels.

Contact Us to request a proposal or to receive more information on our services.

The financial professionals associated with LPL Financial may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

111 Bedford Ct.

Deland, FL 32724

685 Encino Drive

New Braunfels, Texas 78130

813-760-1769

PlanInsight@advizrs.com