Consider making a catch-up contribution to your retirement!

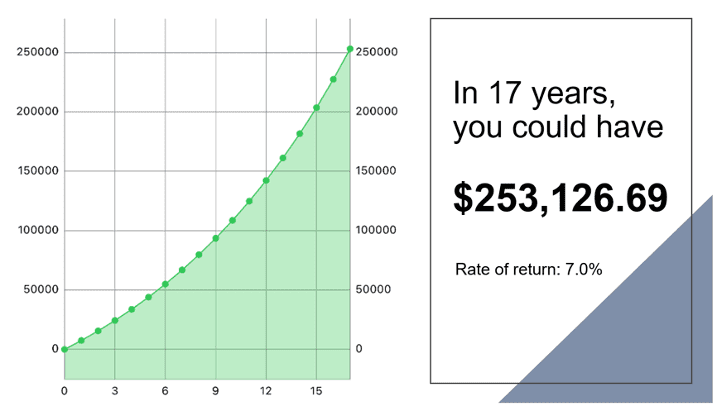

If you contribute $7,500 each year from age 50 to age 67 (17 years), you can make a big impact on your future.

*This example is intended for illustrative purposes only.

When am I eligible to make a catch-up contribution?

If you turn age 50 anytime in the calendar year, you are eligible to contribute an additional $7,500 into your plan as a catch-up contribution. This is in addition to the $22,500 annual limit.

Is the catch-up contribution pre-tax or Roth?

Yes, either type of savings are available for your catch-up contribution. Depending on your income, the Secure Act 2.0 may require a change for your situation to Roth (more information to follow).

What does this all mean?

If you wish to save an additional $7,500 per year, you can accumulate over $250,000 in the next 17 years! As the limits to save increase, you may be able to save even more each year.

If you have any questions, please contact your Advizrs Retirement Plan Consultant at PlanInsight@advizrs.com.

The financial professionals associated with LPL Financial may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

111 Bedford Ct.

Deland, FL 32724

685 Encino Drive

New Braunfels, Texas 78130

813-760-1769

PlanInsight@advizrs.com